How to Choose the Right Question Types for your Survey

Learn about the different survey question types and which make sense for each survey.

In this article:

Overview

When creating a survey, it's important to consider how the question types can influence the quality of responses you receive and the resulting analytics.

In this article, you will learn where each question type excels and when to use different question types.

Discover more ways to support your team and grow with Quantum Workplace. Explore what's possible.

Scaled (Agreement)

What it means:

A statement that requires a single response from a range or scale of potential responses.

What it's good for:

Measuring the intensity of opinions, attitudes, or feelings about a topic.

What the questions will look like:

.gif?quality=high&width=670&height=589&name=2022-11-28_14-44-33%20(1).gif)

What the data will look like:

The percent of responses selecting each option along the scale. Quantum Workplace further simplifies your data by reporting the percent of responses that are favorable, neutral, or unfavorable, as well as the average response.

Understanding Your Data:

For the question, This job is in alignment with my career goals, your results display 83%. This means that 83% of participants responded with either Agree or Strongly Agree to this question.

Best Practices:

- Use scaled items more often than any other question type. Scaled items are the foundation of most Quantum Workplace best practice surveys.

- Write scaled survey items as statements (sentences), not as questions.

- Use Quantum Workplace’s recommended 6-point agreement scale: Strongly Disagree, Disagree, Somewhat Disagree, Somewhat Agree, Agree, Strongly Agree. This provides a detailed understanding of your respondents' perceptions without giving them an overwhelming number of options.

- Ensure that scaled items are worded as positive statements such that you want survey-takers to respond "Agree" or "Strongly Agree" to every item. For example, use the item, "I know I can depend on the members of my team," rather than "I cannot rely on the other members of my team."

- Ensure that the response scale is ordered from "negative" to "positive", such that the most favorable response is on the far right. Research suggests that this eliminates positive-response bias. Quantum Workplace's six-point agreement scale is designed with this in mind.

Single-Choice

What it means:

A question allows a respondent to select one option from a predefined list of choices.

What it's good for:

When you want to understand a clear preference or single choice when you have a good idea of your respondent's favorable options.

What the questions will look like:

.gif?quality=high&width=670&height=423&name=2022-11-28_14-47-07%20(1).gif)

What the data will look like:

The percentage of respondents who chose each of the options.

Understanding Your Data:

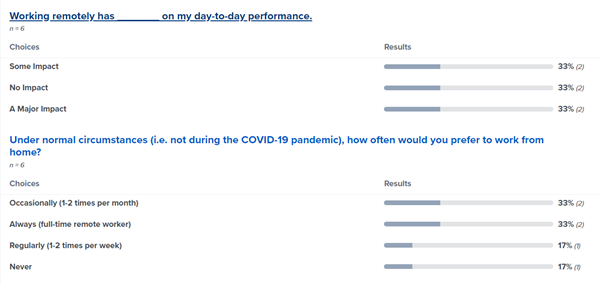

For the question, Working remotely has ___ on my day-to-day performance, you can clearly see that there is no clear preference among the responses. This could indicate that any larger decision regarding remote work would require more strategizing.

Best Practices:

- Be intentional about the list of options you present. Include enough variety for respondents to choose from but not so many where some options seem redundant or the list is overwhelming. Also, don’t list options you can’t deliver on. If you ask employees what food they’d like to have served at the company picnic, don’t list a steak dinner that busts your budget.

- Consider using “Other” as a response option for instances in which none of your answer options apply to a respondent. Allowing the respondent to then leave a comment is a great way to collect more insight.

- Use Single-Choice questions for Yes/No questions.

Multi-Choice

What it means:

A question allows a respondent to select one or more options from a predefined list of choices.

What it's good for:

When you want to understand preferences or choices and you have a good idea of what options you want your respondents to choose from.

What the questions will look like:

.gif?quality=high&width=670&height=547&name=2022-11-28_14-51-10%20(1).gif)

What the data will look like:

The percent of respondents who chose one or multiple of the options.

Note: if you limit a respondent to selecting just one response, the percentages will add up to 100%. If you allow a respondent to choose more than one response, the percentages likely will not add up to 100%.

Understanding Your Data:

When looking at the survey question above, the data indicates that everyone prioritized how they would match with the job. The same can be said about employee compensation and company reputation, to a lesser degree.

Alternatively, the data also indicates that office location and interview experience weren't as pivotal to candidates choosing your organization.

Best Practices:

- Be intentional about the list of options you present. Include enough variety for respondents to choose from but not so many where some options seem redundant or the list is overwhelming. Also, don’t list options you can’t deliver on. If you ask employees what food they’d like to have served at the company picnic, don’t list a steak dinner that busts your budget.

- Consider using “Other” as a response option for instances in which none of your answer options apply to a respondent. Allowing the respondent to then leave a comment is a great way to collect more insight.

- Limit respondents to choose one option if you prefer to know their very favorite or allow multiple options if you want to know any preference.

Rank

What it means:

A question allows a respondent to rank a predefined list of options in order of preference or importance.

What it's good for:

Expanding beyond multichoice questions, rank allows you to understand the order of a respondent’s preference or choices.

What the question will look like:

.gif?quality=high&width=670&height=698&name=2022-11-28_14-54-51%20(1).gif)

What the data will look like:

Among the options, you’ll get to see what percent were ranked first, second, third, fourth or lower, or not ranked.

Understanding Your Data:

The data indicates that Time Off & Flexible Hours are significantly important to your employees. Each of the responses can be expanded to see where the option was ranked for every response.

Best Practices:

- As with multichoice, create your list so that there are a variety of options to rank, but not so many that options seem redundant or it takes too much time to decide.

- Consider designing the question so that respondents rank their top 2 or 3 choices instead of ranking all possible options. This saves the respondent time and brainpower but still provides you with the most critical data.

While valuable, responding to rank questions can be time-consuming. Try to limit the number of rank questions that appear on your survey compared to other types.

Open-Ended

What it means:

A question allows a person to respond in their own words.

What It’s Good For:

Understanding context, gaining deeper insights and collecting suggestions or ideas. Open-ended questions are not as useful when you need a quick understanding of responses.

What the question will look like:

.gif?quality=high&width=670&height=372&name=2022-11-28_14-57-48%20(1).gif)

What the data will look like:

You’ll be able to read the responses exactly as they were written. This data can be found under the Comments tab of your analytics. Learn more about Theme & Sentiment Analysis.

Understanding Your Data:

Open-ended questions allow survey participants to respond to questions in any way they see fit. When viewing analytics for open-ended responses, Quantum Workplace identifies common sentiments among your responses. Learn more here.

Best Practices:

- Avoid using open-ended questions when you need quick insight, as it takes more time to review open-ended questions than other question types and you may receive some responses that you can't deliver on. Instead, use scaled, multichoice or rank questions.

- Think ahead to what type of responses will be most helpful. If you want respondents to share their opinion on something specific, word your question so that they’ll respond accordingly.

- Avoid generic questions like “What other information would you like to share?”

- Read the comments. If your employees take the time to answer open-ended questions, you should take the time to consider their feedback.

NPS

What it means:

The Net Promoter Score (NPS) is a common index used to measure loyalty or engagement. It can also be used to assess the opinions of your employees.

What it's good for:

When you only have space on your survey for one question that addresses loyalty or engagement and you prefer the NPS format.

What the question looks like:

.gif?quality=high&width=670&height=444&name=2022-11-28_15-01-48%20(1).gif)

What the data will look like:

Responses are grouped into three main categories.

- Promoters: Percent of responses that are 9 or 10

- Passives: Percent of responses that are 7 or 8

- Detractors: Percent of responses that are 0 to 6

The NPS Score is the percentage of Promoters minus the percentage of Detractors.

Understanding Your Data:

NPS questions are ideal for understanding how much your survey participants rate the subject in question.

Considerations:

NPS doesn’t provide you with an understanding of why someone is a promoter or detractor. Consider adding other question types to better understand the opinions that influence a person’s NPS response.

See Also:

Designing your Employee Engagement Survey

Quick Guide: How to Write Effective Questions